Understanding Form 433F Rev 7-2024: A Comprehensive Guide

Overview of Form 433F Rev 7-2024

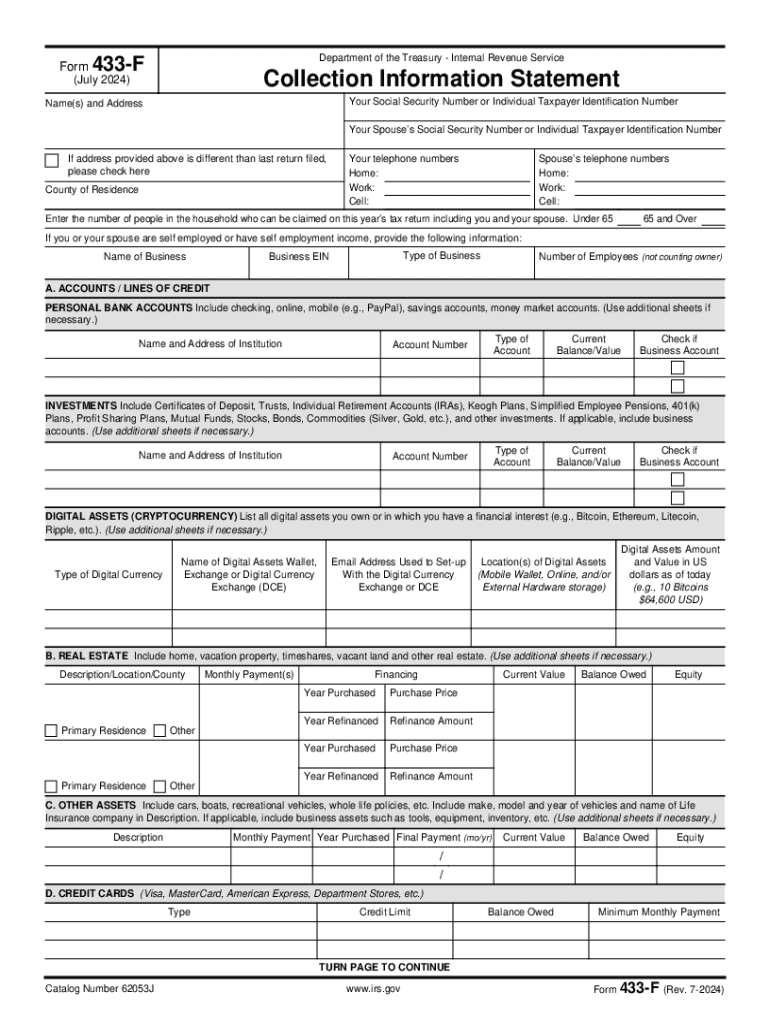

Form 433F Rev 7-2024 is a crucial document used by individuals dealing with the Internal Revenue Service (IRS) regarding their financial status. This form is essential for taxpayers seeking to establish a payment plan, request an offer in compromise, or negotiating their tax liabilities. The revised version offers clarity in sections and updated guidelines that reflect the IRS’s current collection strategies.

The primary purpose of Form 433F is to provide a detailed overview of a taxpayer's financial condition, including income, assets, debts, and monthly living expenses. This information assists the IRS in evaluating how much a taxpayer can reasonably afford to pay towards their tax liabilities. The 7-2024 revision brings forth a streamlined structure that facilitates easier filling and a clear outline for required disclosures.

Importance of Form 433F in tax situations

Filing Form 433F is critical for taxpayers under potential IRS collection actions, such as levies or liens. Understanding when and why to submit this form ensures compliance with IRS regulations and can ultimately alleviate financial stress. The IRS collection processes can be overwhelming, and proper adherence to their requirements can lead to more favorable outcomes, including reductions in payment amounts or alternative payment arrangements.

Failure to file Form 433F or submit an incomplete application may worsen a taxpayer's financial plight. The IRS may pursue aggressive collection methods, including garnishments or bank levies. Hence, it is imperative to prevent such occurrences by accurately completing and submitting the necessary forms promptly.

Who needs to file Form 433F?

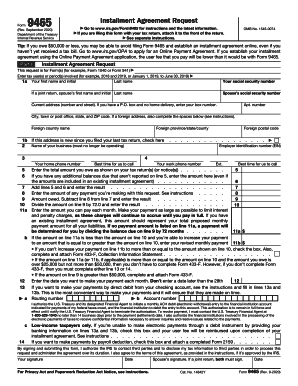

Any taxpayer facing difficulties in meeting their tax obligations should consider filing Form 433F. This form is generally required for individuals, couples, and sole proprietorships who owe significant tax debts or are seeking payment relief from the IRS. Specific scenarios, such as taxpayers proposing an installment agreement or applying for an offer in compromise, trigger the necessity for this form.

Moreover, Form 433F has a broader context, often standing in relationship to similar IRS forms such as Form 433A and Form 433B. Each has distinct requirements based on the taxpayer's employment situation or financial structure, meaning understanding when to use Form 433F versus its counterparts can dramatically impact the outcome of tax negotiations.

Step-by-step instructions for filing Form 433F

Step 1: Gathering necessary information

Before diving into Form 433F, gather crucial personal information, such as your name, contact details, and Social Security Number (SSN). Additionally, you will need to compile your financial information, including a list of all assets, income sources, and debts. This preparatory work is vital for accurate completion of the form and understanding your financial landscape.

Step 2: Completing the form

When filling out Form 433F, it’s important to follow each section meticulously. Pay special attention to income and expense details, as inaccuracies can lead to complications or delays. It’s common for taxpayers to mistakenly underestimate their expenses or overstate their income, which could misrepresent their financial situation. Take your time and use honest figures.

Step 3: Reviewing your submission

After completing the form, review your submission thoroughly. Create a checklist of critical fields, ensuring all requested information is included and numbers are accurately tallied. This review step is vital, as submission of incorrect or incomplete forms can lead to rejection or additional requests from the IRS.

Step 4: Submitting Form 433F

There are multiple methods to submit Form 433F, including mailing a hard copy to the designated IRS address or using electronic filing options via tax professionals. Ensure that you acquire confirmation of receipt, which can serve as vital documentation should issues arise in processing your submission.

Information required on Form 433F

Section A: Personal and contact information

In Section A of Form 433F, clarity is essential. You'll be required to provide details such as your full name, address, phone number, and SSN. This primary identification is crucial for the IRS to process your form accurately and connect it with your taxpayer profile.

Section B: Financial overview

A complete financial overview is crucial in Section B. This section covers income from various sources, including jobs, investments, and any additional revenue streams. Detail your assets and liabilities, ensuring you list both tangible and intangible items. This comprehensive financial disclosure shapes how the IRS views your ability to pay.

Section : Monthly expenses

In Section C, accurately listing your monthly expenses, such as housing costs, utilities, and other necessary living expenses, is vital. Ensure you don't overlook any categories, as the IRS uses this information to assess your net income and determine your financial flexibility.

Section : Additional financial documentation

Attach important documentation to your completed Form 433F. Items such as recent tax returns, pay stubs, and bank statements bolster your claims and provide the IRS with a clearer picture of your financial situation, enhancing the credibility of your submission.

What happens after Form 433F submission?

Upon submission of Form 433F, the IRS begins the review process. During this period, they may reach out for further information or documentation, particularly if the form is incomplete or unclear. Understanding the nuances of this process can help taxpayers remain proactive and prepared to respond promptly.

IRS responses can significantly vary. You may receive an approval indicating your information is accepted, or a denial if your financial situation does not warrant relief. Generally, the timeline for a follow-up can span from a few weeks to several months, and being patient while remains compliant with IRS communications is crucial.

Tips for filing Form 433F effectively

Filing Form 433F can be straightforward with some best practices. Firstly, ensure all information is current and accurate. Utilize resources such as pdfFiller to facilitate easy editing of your PDFs and ensure your form reflects precise details. This platform not only enables easy eSigning but also provides features that enhance collaboration across teams when necessary.

Additionally, pdfFiller offers numerous tools to double-check your entries and ensure compliance with IRS standards. Document editing features allow you to refine your figures and improve clarity, while the collaboration tools can simplify input from various stakeholders, making the process more seamless.

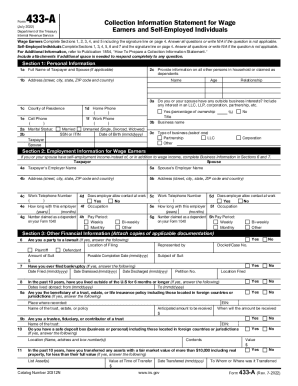

Understanding the differences between related forms

Taxpayers often mistakenly confuse Form 433F with similar documents like Form 433A and Form 433B. The distinctions among these forms lie primarily in their intended use and the specific financial scenarios they address. Form 433A is geared towards individuals, while Form 433B applies to businesses.

Choosing the correct form is crucial for IRS procedures, as each form aims to collect distinctive information relevant to the taxpayer’s situation. For example, a self-employed individual might require Form 433A for a detailed financial analysis, whereas a corporate entity may need to provide insight through Form 433B.

Compliance and standards for IRS Form 433F

Adhering to IRS compliance standards while completing Form 433F is vital. The IRS has established expectations regarding financial disclosures, ensuring taxpayers report their financial realities transparently. National Standards and Allowances play a pivotal role in determining acceptable expense levels according to the IRS, making understanding these guidelines crucial.

Taxpayers should also base their budgeting on IRS allowances, reflecting the realistic living expenses acknowledged by the agency. This effort in compliance can significantly influence the outcome of negotiations surrounding tax liabilities and forms the foundation for effective financial engagement with the IRS.

Tailoring your submission based on your financial situation

Every taxpayer’s financial situation is unique, necessitating a tailored approach to filling out Form 433F. For instance, self-employed individuals often face different circumstances compared to those receiving a regular salary. It's essential to accurately reflect one’s cash flow, variable expenses, and potential deductions that might impact overall financial standings.

Additionally, specific sectors may impose unique considerations that should be accounted for in your submission. Taxpayers must adequately address industry-specific financial realities that could influence negotiated outcomes with the IRS, ensuring a comprehensive view of their financial landscape is presented through Form 433F.