IRS 433-F 2024-2026 free printable template

Instructions and Help about IRS 433-F

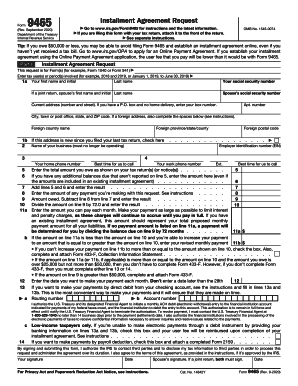

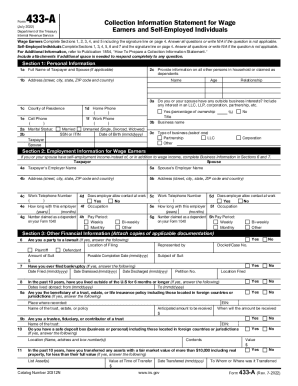

How to edit IRS 433-F

How to fill out IRS 433-F

Latest updates to IRS 433-F

All You Need to Know About IRS 433-F

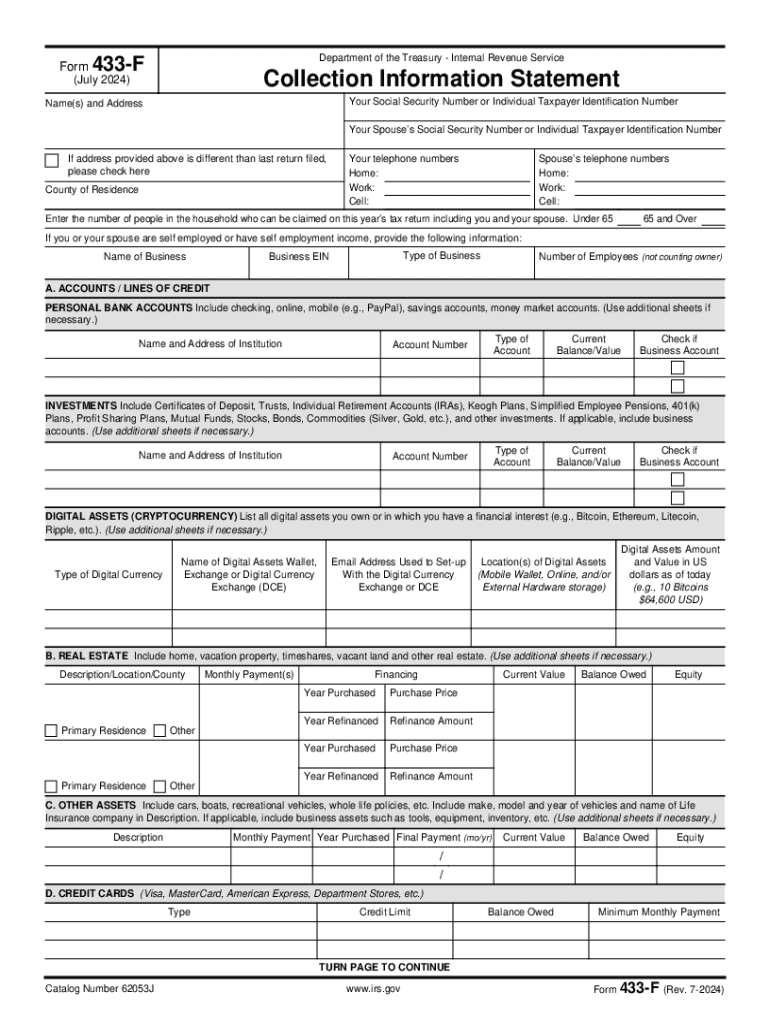

What is IRS 433-F?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 433-F

What should I do if I realize I've made a mistake on my IRS 433-F?

If you discover an error after filing the IRS 433-F, you can submit a corrected version. It’s important to clearly indicate that it’s an amendment and provide the necessary corrections. Be sure to keep documentation supporting the corrections for your records.

How can I check the status of my filed IRS 433-F?

To verify the status of your IRS 433-F after submission, you can use the IRS online tracking system if you e-filed. For mailed forms, it’s advisable to check with the post office or waiting a few weeks to ensure processing time has elapsed.

Are e-signatures accepted for the IRS 433-F, and how does it affect filing?

Yes, e-signatures are accepted for the IRS 433-F, facilitating electronic submissions. Ensure that your e-signature complies with IRS guidelines as it may affect the validity of your filed form.

What common errors do people make when completing the IRS 433-F, and how can I avoid them?

Common errors on the IRS 433-F include incorrect financial calculations and incomplete information. To avoid these mistakes, double-check all figures and ensure that each relevant section is filled out accurately before submission.

How do I respond if I receive a notice from the IRS after filing my 433-F?

If you receive a notice from the IRS regarding your filed IRS 433-F, carefully review the letter to understand the issue presented. Prepare the requested documentation and respond promptly to resolve the matter, ensuring to maintain copies for your records.

See what our users say